All Categories

Featured

Consider Using the DIME formula: penny means Debt, Earnings, Home Mortgage, and Education and learning. Total your debts, home loan, and college expenditures, plus your income for the number of years your family requires protection (e.g., till the youngsters run out your house), and that's your coverage demand. Some monetary specialists compute the amount you require utilizing the Human Life Worth approach, which is your lifetime earnings prospective what you're making now, and what you expect to earn in the future.

One way to do that is to seek business with solid Financial strength ratings. what does the term illustration mean when used in the phrase life insurance policy illustration. 8A business that underwrites its own policies: Some business can market plans from another insurance provider, and this can add an additional layer if you desire to change your plan or in the future when your household needs a payment

The Term Illustration In A Life Insurance Policy

Some companies use this on a year-to-year basis and while you can expect your rates to increase considerably, it may deserve it for your survivors. An additional way to compare insurance companies is by looking at online consumer evaluations. While these aren't most likely to inform you much regarding a company's monetary security, it can inform you just how very easy they are to deal with, and whether cases servicing is an issue.

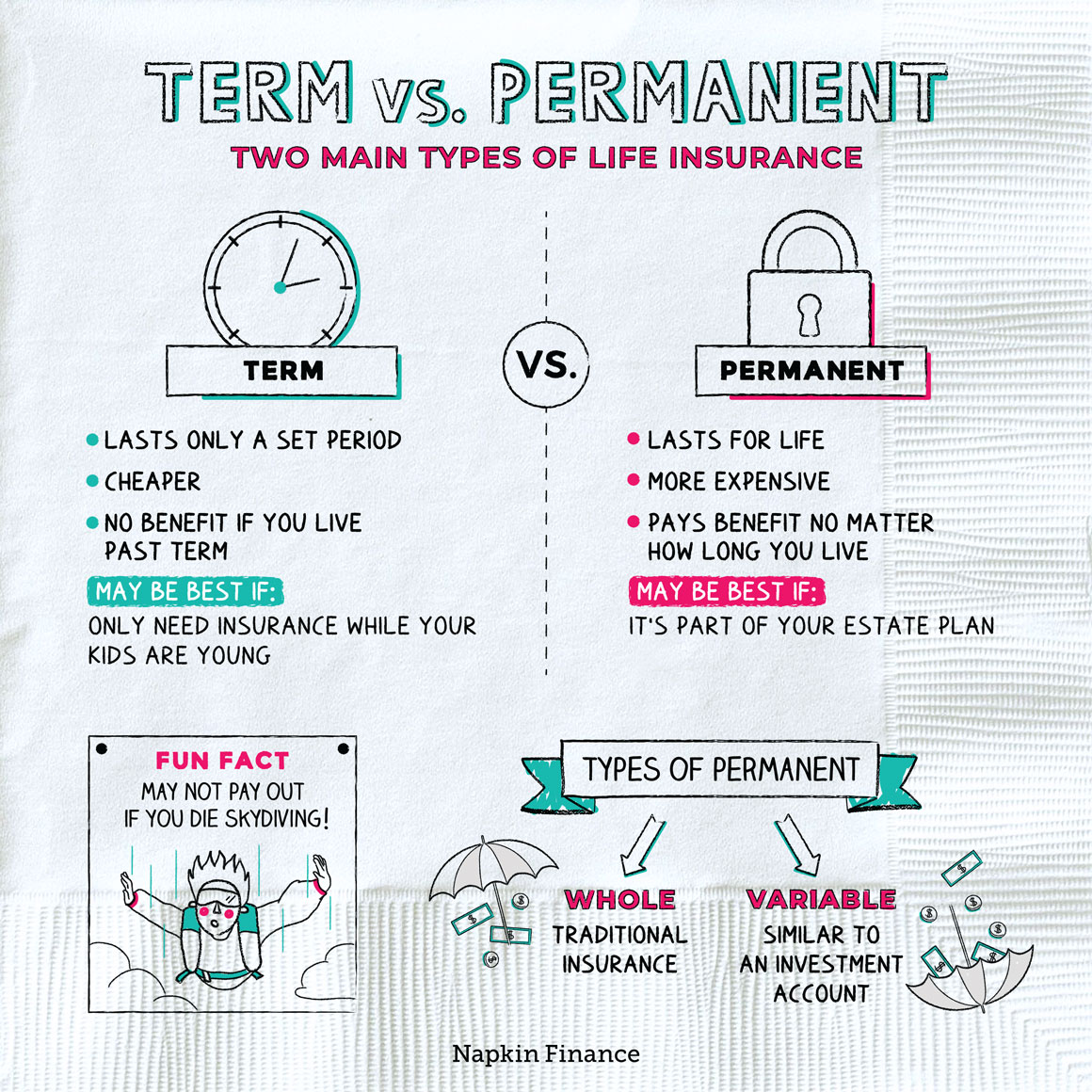

When you're more youthful, term life insurance coverage can be a straightforward means to secure your enjoyed ones. As life adjustments your economic top priorities can as well, so you might desire to have whole life insurance coverage for its lifetime coverage and added benefits that you can use while you're living.

Authorization is ensured no matter your wellness. The costs won't raise once they're established, yet they will certainly go up with age, so it's a good idea to secure them in early. Discover more about exactly how a term conversion works.

1Term life insurance policy offers short-lived defense for a crucial duration of time and is normally more economical than long-term life insurance policy. what is term rider in life insurance. 2Term conversion standards and restrictions, such as timing, may use; as an example, there may be a ten-year conversion benefit for some items and a five-year conversion advantage for others

3Rider Insured's Paid-Up Insurance policy Acquisition Choice in New York. There is an expense to exercise this rider. Not all participating policy owners are eligible for rewards.

Latest Posts

Life Insurance Level Term

Final Expense For Seniors

Burial Policy Vs Life Insurance